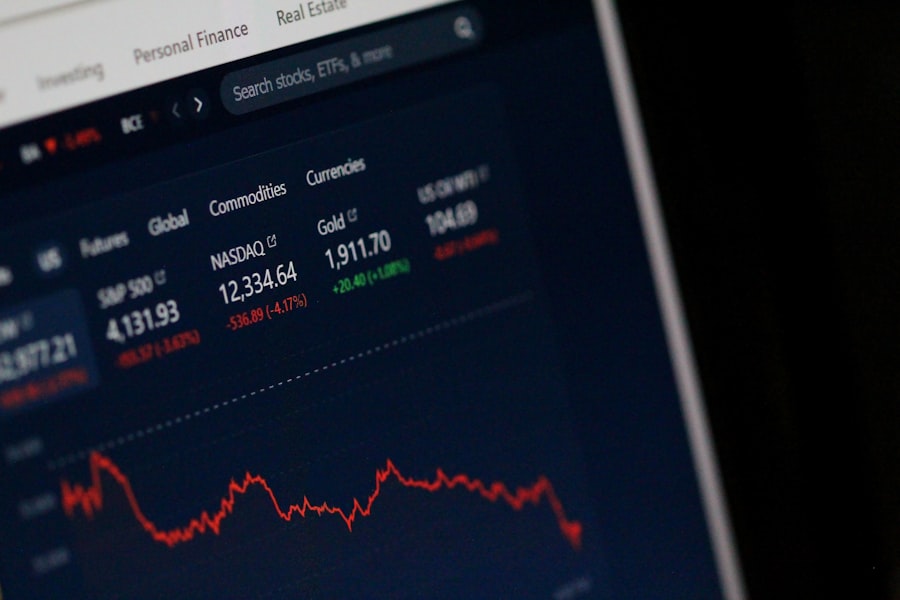

Finance is a dynamic and diverse field offering numerous career opportunities for individuals skilled in mathematics, analysis, and problem-solving. The industry encompasses various roles, including investment banking, financial planning, asset management, market analysis, and financial advising. These positions cater to different skill sets and interests within the broader finance sector.

The finance industry is known for competitive salaries and opportunities for career advancement, making it an attractive option for those seeking a successful and potentially lucrative career path. Finance professionals play a crucial role in the global economy by managing and allocating financial resources, assessing risks, and making strategic investment decisions. As financial markets become increasingly complex and the demand for financial services grows, the need for skilled finance professionals continues to rise.

Technological advancements are reshaping the industry, creating new opportunities in areas such as financial technology (fintech) and data analytics. These developments offer potential career paths for both recent graduates and experienced professionals looking to transition into the finance sector. The finance industry’s importance in the global economy, combined with its diverse range of roles and potential for career growth, makes it an attractive field for individuals with strong analytical and problem-solving skills.

As the industry evolves, it continues to offer new challenges and opportunities for those interested in pursuing a career in finance.

Key Takeaways

- Careers in finance offer a wide range of opportunities in various sectors such as banking, investment, and corporate finance.

- Pursuing a career in finance requires strong analytical skills, attention to detail, and the ability to work well under pressure.

- A degree in finance, accounting, economics, or business administration is typically required for entry-level positions in the finance industry.

- Job opportunities in finance include roles such as financial analyst, investment banker, and financial manager, with potential for high earning potential and career growth.

- Specializations in finance include areas such as risk management, financial planning, and corporate finance, each offering unique career paths and opportunities for advancement.

Tips for Pursuing a Career in Finance

A successful career in finance requires careful planning and preparation. To get started, it’s essential to gain a deep understanding of the finance industry and the various career paths available.

Understanding the Finance Industry

Take the time to research the different roles within finance, such as investment banking, corporate finance, financial planning, and risk management. This will help you determine which area aligns with your interests and strengths.

Building Your Network and Education

Networking with professionals in the field can provide valuable insights and connections that can help you kickstart your career. In addition to gaining industry knowledge, pursuing relevant education and certifications can significantly enhance your prospects in the finance industry. Consider obtaining a degree in finance, economics, accounting, or a related field to build a strong foundation of knowledge and skills.

Demonstrating Expertise and Commitment

Many finance professionals also pursue certifications such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) designation to demonstrate their expertise and commitment to professional development. Internships and work experience in finance-related roles can also provide valuable hands-on experience and help you build a strong professional network.

Education and Skills Required for a Career in Finance

A career in finance typically requires a strong educational background and a set of specific skills that are essential for success in the industry. While there are various paths to entering the finance field, obtaining a relevant degree is often a key requirement for many finance roles. A bachelor’s degree in finance, accounting, economics, or a related field can provide the foundational knowledge needed to understand financial markets, investment principles, and financial analysis.

Many employers also look for candidates with advanced degrees such as a Master of Business Administration (MBA) or a Master’s in Finance for more specialized roles. In addition to formal education, there are several skills that are highly valued in the finance industry. Strong analytical skills are essential for evaluating financial data, assessing risks, and making informed decisions.

Attention to detail and the ability to work with complex numerical data are also important qualities for finance professionals. Effective communication skills are crucial for presenting financial information to clients or stakeholders and building relationships with colleagues and clients. Furthermore, proficiency in financial software and tools such as Excel, Bloomberg Terminal, and financial modeling software is often required for many finance roles.

Job Opportunities in the Finance Industry

The finance industry offers a wide range of job opportunities across different sectors and specializations. Some of the most common roles in finance include investment banking, financial planning, corporate finance, risk management, and asset management. Investment bankers work with corporations and government entities to raise capital through issuing securities or advising on mergers and acquisitions.

Financial planners help individuals and families manage their finances, plan for retirement, and achieve their financial goals. Corporate finance professionals are responsible for managing a company’s financial activities, such as budgeting, forecasting, and capital investment decisions. Risk management professionals assess and mitigate financial risks within organizations by implementing strategies to protect against market fluctuations or unforeseen events.

Asset managers oversee investment portfolios on behalf of clients or institutions, making strategic investment decisions to maximize returns while managing risks. Additionally, there are opportunities in areas such as financial analysis, wealth management, insurance, real estate finance, and fintech that cater to different interests and skill sets within the finance industry.

Exploring Different Specializations in Finance

Within the broad field of finance, there are various specializations that cater to different interests and career goals. For those interested in investment management and analysis, roles such as portfolio manager, research analyst, or trader may be appealing. These roles involve evaluating investment opportunities, managing portfolios, and making buy/sell decisions based on market trends and economic indicators.

Financial planning offers opportunities for individuals who enjoy working with clients to create personalized financial plans, manage investments, and provide guidance on retirement planning, tax strategies, and estate planning. Corporate finance encompasses roles such as financial analyst, treasurer, or chief financial officer (CFO) within companies, where professionals are responsible for managing financial activities such as budgeting, forecasting, capital allocation, and financial reporting. Risk management involves identifying potential risks within an organization’s operations or investment portfolios and implementing strategies to mitigate those risks.

Other specialized areas within finance include real estate finance, insurance, fintech, and private equity, each offering unique opportunities for professionals with specific expertise and interests.

Advancement and Growth in Finance Careers

Vertical Advancement in Finance

Many finance professionals start their careers in entry-level roles such as financial analyst or junior associate and progress to more senior positions with increased responsibilities over time. Advancement in the finance industry often involves gaining specialized expertise through certifications or advanced degrees, as well as demonstrating strong performance and leadership skills.

Examples of Career Progression

For instance, individuals working in investment banking may progress from analyst to associate to vice president or managing director as they gain experience and build a track record of successful deals. Similarly, financial planners may advance from entry-level advisor roles to senior financial planner or wealth manager positions as they build their client base and expertise in financial planning strategies.

Opportunities for Lateral Moves and Leadership Roles

In addition to vertical advancement within specific roles, there are also opportunities for lateral moves into different areas of finance or leadership positions within organizations. This allows finance professionals to diversify their skills and experience, taking their careers to new heights.

Conclusion and Final Thoughts on Careers in Finance

In conclusion, a career in finance offers diverse opportunities for individuals with a passion for numbers, analysis, and strategic decision-making. Whether you are interested in investment banking, financial planning, corporate finance, or risk management, the finance industry provides a range of roles that cater to different skill sets and interests. Pursuing relevant education, gaining industry knowledge, and developing key skills such as analytical abilities and effective communication can significantly enhance your prospects in the finance industry.

With the increasing complexity of financial markets and the growing demand for financial services globally, the need for skilled finance professionals has never been greater. The finance industry also offers ample opportunities for career advancement and growth through continuous learning, gaining specialized expertise, and demonstrating strong performance. As technology continues to reshape the finance industry, new opportunities are emerging in areas such as fintech and data analytics that offer exciting prospects for individuals looking to build successful careers in finance.

Whether you are just starting your career or considering a transition into finance from another field, the diverse opportunities within the finance industry make it an attractive option for those seeking a challenging and rewarding career path.

If you’re interested in exploring careers in finance, you may also want to consider the options available to you at 16. This article on careershelp.co.uk provides valuable information on the different paths you can take at this age to set yourself up for a successful career in finance. It’s important to make informed career choices, and this article on careershelp.co.uk offers guidance on how to do just that. Additionally, investing in training is crucial to safeguarding your future in the finance industry, as discussed in this article on careershelp.co.uk. These resources can provide valuable insights and opportunities as you explore a career in finance.

FAQs

What are some common career paths in finance?

Some common career paths in finance include financial analyst, investment banker, financial planner, accountant, and risk manager.

What skills are important for a career in finance?

Important skills for a career in finance include analytical skills, attention to detail, communication skills, problem-solving abilities, and a strong understanding of financial principles and markets.

What are some tips for pursuing a career in finance?

Some tips for pursuing a career in finance include gaining relevant education and certifications, networking with professionals in the industry, gaining practical experience through internships or entry-level positions, and staying updated on industry trends and developments.

What are some opportunities for advancement in the finance industry?

Opportunities for advancement in the finance industry include moving into management roles, specializing in a specific area of finance (such as investment management or corporate finance), pursuing advanced degrees or certifications, and taking on leadership positions within organizations.