Today´s Inland Revenue

The range of work undertaken by the Inland Revenue is broadening. It includes helping people to pay the right amount and receive what they are entitled to by providing clear advice and literature about:

- Income Tax – Advising people how and when to pay. Helping taxpayers to calculate their tax liability. Publishing the tax rates.

- Tax Credits – Paying child tax credits directly to families with children.

- National Minimum Wage – Ensuring employers pay at least the national minimum wage.

- Student Loan Repayments – Helping students who graduate to schedule their student loan repayments after they start earning at a particular level.

The Inland Revenue is in the public (i.e. government) sector of the economy. Historically, the Inland Revenue (and HM Customs and Excise) have been in charge of collecting taxes to enable the government to raise the revenue it requires to fund important activities e.g. education and health services and all other public spending.

Income tax is an important source of government revenue. The amount that taxpayers contribute depends on their income. Everybody has a tax-free allowance on some of the money they earn or receive. Thereafter, the amount of tax paid increases with the size of income earned or received. As its workload increases, and as the ways in which it interacts with the public become more varied, the Inland Revenue is improving the efficiency of its communication systems.

Communication

Now that the Inland Revenue plays a much wider role in society it must inform major stakeholders, crucially the public, what this new role involves.

The communication process needs to define and explain:

- WHAT the Inland Revenue wants to achieve – The Business Direction

- WHY it exists – The Core Purpose

- HOW it is going to do it – The Core Traits.

What?

The Inland Revenue’s Business Direction defines the overall goal of the business so that everyone (staff, customers and stakeholders) has a clear and consistent understanding of what the business is aiming to achieve:

‘We aim to ensure that everyone understands and receives what they are entitled to, and understands and pays what they owe‘.

Why?

At its most basic level, the Revenue’s Core Purpose, or reason for being, is to ensure that ‘everyone contributes to the UK’s needs’.

We live in a community in which we all have responsibilities towards each other. By paying tax and receiving tax credits, child benefit (and soon child trust fund) we are able to contribute to society and to receive our entitlements.

How?

Market research carried out by the Inland Revenue highlighted the type of service and communications that consumers expect. The Inland Revenue aims to achieve its Business Direction by being:

- Objective (decisions made on the basis of fact, not opinion)

- Knowledgeable

- Efficient

- Clear

- Human

- Reasonable.

These are the department’s Core Traits which advise how staff should behave with each other and with customers in all mediums.

Internal and external communication

Organisations communicate:

- Internally – within the organisation itself

- Externally – with stakeholders and customers.

Internally, the Inland Revenue needs to ensure that all its employees understand the new developments and the changing nature of their responsibilities. External communication involves ensuring that stakeholders and customers are kept informed. For example:

- Business customers need to know about the enforcement of the minimum wage.

- The government requires (and demands) to know how the Inland Revenue is implementing new policy initiatives such as the payment of tax credits.

- Individual taxpayers and tax credit recipients want to be kept informed about arrangements for paying taxes and receiving tax credits.

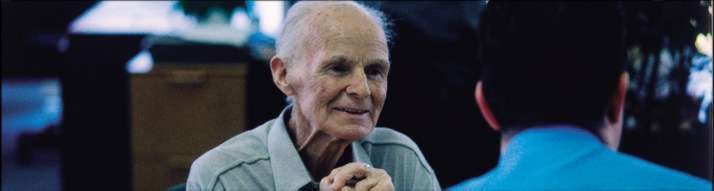

One Core Trait that illustrates the Inland Revenue’s modern approach is the steps it takes to portray itself as an organisation of human beings rather than an unfeeling administrative machine. For external communication, it expects its employees to ‘be open to customer problems and try to understand the situation from their perspective.’ Internally, this translates into people being ‘approachable and understanding at all times’ e.g. in their dealings with colleagues. The benefits of improved customer service and communication

In looking to improve its customer service, the Inland Revenue is pursuing ‘enlightened self-interest’ – there are benefits to itself as well as to customers. For example, a policy of ‘getting things right the first time means that:

- Relationships with customers are improved

- The Inland Revenue saves time, money and effort, and so do customers

- Individuals and businesses are more likely to comply with tax and benefit requirements

- It frees up Inland Revenue time to deal with other key work – for example – identifying and pursuing persistent tax evaders.

Because the Inland Revenue has progressed from being solely a ‘tax assessing and collecting department’ to a customer-focused provider of a range of services, it has needed to change the ways in which it operates and how people within it work: it has needed to alter its culture. The Inland Revenue is in the process of developing this new culture. Any attempt to change an organisation’s culture takes time, so it is important to train staff, and to communicate regularly with them as part of ‘winning over hearts and minds’.

Methods of communication

The best communication methods succeed in putting across the right message in a clear, unambiguous way that gets noticed by the target audience, whilst also saving on time and cost. Good communicators succeed in choosing the best medium of communication for the particular purpose in mind. For external communications, the Inland Revenue typically uses:

- Written communications dispatched by mail e.g. statements detailing tax liabilities and payment schedules. Paper-based items sent by mail have the advantage of providing a clear, fileable statement that is likely to reach its intended recipient.

- Oral communications: customers can ‘phone in’ with their queries. They can also speak directly to the employee who is managing their account. Oral communication allows most misunderstandings to be resolved immediately.

- Face-to-face communications e.g. a visit to the local office by arrangement. This can save time and subsequent communications.

- Online communications. Today consumers can complete their Tax Return, claim tax credits and do a variety of other business with the Inland Revenue directly online, thereby saving a great deal of time. An important advantage of this method is that ongoing ‘help’ is provided by pop-up help facilities. This is a cheap, quick and efficient means of communication.

- Advertising on TV and in the press e.g. to alert people to tax payment deadlines or to eligibility for tax credits. By this method the Inland Revenue is able to communicate with millions of customers cost effectively.

The Inland Revenue uses similar methods for internal communications e.g.

- Written communications – internal memos, staff magazines, notices or posters on staff notice boards.

- Oral communications – phone conversations between employees.

- Face-to-face – team briefings, meetings and presentations.

- Online – internal e-mails and intranet.

Face-to-face conversations and oral communications make possible more detailed discussions to clarify issues. Written communications provide clear statements of discussions and their outcome can be recorded and filed. Online communications have revolutionised ways of working by providing fast, cheap and efficient ways of interacting that can easily be stored within files.

Online communications can also be easily edited and shared between teams of employees working together. For example, a customer’s account details can be accessed both in a local office and in the central tax-paying department in Glasgow, simultaneously.

Communicating the process of culture change

One of the Inland Revenue’s biggest communications exercises recently has involved explaining to its staff the details and the implications of the organisation’s ongoing culture change. This exercise in ‘spreading the message’ has involved approximately 80,000 staff based at over 150 sites across the UK. The key idea to put across was that the Inland Revenue has an increased emphasis on being truly customer-focused. Every member of staff needs to be familiar with and to understand the strategy, and wherever possible, to have the opportunity to discuss the changes. The initial communication exercise took place between November 2002 and March 2004. The key forms of communication were:

- Face-to-face workshops for groups of employees. Some sessions involved as few as 8 staff. Others involved as many as 300. The workshops were run in four sessions/modules with a fifth module for managers. Specially prepared materials and activities were developed to communicate the key messages and to stimulate group discussions. These sessions were arranged flexibly to fit around employees’ daytime commitments.

- Written booklets and a poster were produced for each of the modules.

- The Inland Revenue’s intranet was used to provide additional information and feedback. For example, feedback from the trainers was published online.

- CD ROMs were used to store PowerPoint slides and guidance for the facilitators who led the sessions.

- A specially prepared video accompanied the first module.

- Additional features and articles about the change process appeared in staff magazines.

It is particularly important for a customer service organisation to develop good communication channels and processes with all of its stakeholders and especially with its customers and employees. The Inland Revenue operates in a fast changing world and its culture is changing to become more customer-focused. It has assumed responsibility for new areas of work, and has developed sophisticated modern internal and external systems to enhance multi-channel communications. It is vital that responsive, informed employees identify and meet their customers’ requirements as quickly as possible. To meet this challenge, the Inland Revenue has embraced a range of communication methods that take full advantage of modern technology.

At the same time, it has engaged in a huge internal communications programme to deliver the new customer focus. The Core Traits (How?), Core Purpose (Why?), and Business Direction (What?) will become embedded in the new culture in the course of time. All new employees will be inducted into the new way of working and will experience the new culture from the outset. The tracking research into the changes in perceptions of the Inland Revenue shows that customers are already experiencing the difference and, it is hoped, this will continue to improve.